[ad_1]

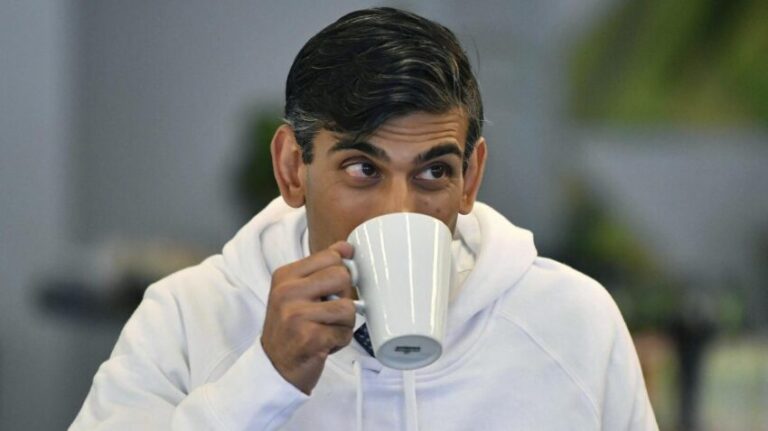

Rishi Sunak has asked the Royal Mint to launch a non-fungible token (NFT) as part of plans to turn Britain into a “global cryptoassets hub”.

NFTs are digital files that serve as a certificate of ownership of a digital asset such as images, video and audio.

The Royal Mint, the coin-maker which is ultimately owned by the government, said its first NFT range would be available from this summer.

John Glen, the City minister, said that the Royal Mint’s NFT was “an emblem of the forward-looking approach” the Treasury plans to take.

The government announced a number of measures aimed at making the UK an attractive place to start and scale crypto-companies. It said that stablecoins — digital currencies pegged to traditional currencies — will be brought within regulation to pave the way for use as a form of payment.

The Treasury will also review how the tax system could encourage further development of the cryptoasset market in the UK.

Glen, who was speaking at the Innovate Finance Global Summit in London, acknowledged concerns over cryptoassets, including the potential to harm consumers and provide a platform for illicit activity free from government oversight.

Andrew Bailey, the Bank of England governor, warned in a separate speech yesterday that cryptocurrencies created an “opportunity for the downright criminal”.

But Charles Kerrigan, a fintech partner with CMS, the law firm, said: “This is exactly what the industry has been calling for — to be judged on the reality of the innovation case by case rather than visiting the sins of the worst actors on the whole community.”

[ad_2]

Source link

0 Comments